Asset Utilization Ratios Include All of the Following Except:

Adebt to total assets Btimes interest earned. 2000000 400000 5.

Profitability Ratios Calculate Margin Profits Return On Equity Roe

B Net Income Average Total Assets ROI.

. All of the following accounts are considered to be current assets on the balance sheet except. Asset utilization may also include other ratios like debtor days or any of the following relationships. Companies with low asset turnover ratios are likely to be operating below their full capacity.

A Increase current assets. D Turnover x Margin ROI. Debt to equity refers to the amount of money and retained earnings invested in the company.

B Decreasing current assets. Debt Utilization Ratios Types Profitability Ratios. Financial analyses have highlighted relationship.

69 Which financial ratio is a measure of the ability of the company to meet all of its fixed-charge obligations. Both banks have similar interest income to asset ratios and non-interest income to asset ratios. They may also indicate that the assets are obsolete.

All of the following are debt utilization ratios except. D Decreasing total liabilities. If a company has a debt to total assets ratio of 50 and total assets of 5000000 what amount of debt is the company carrying.

Asset utilization ratios include all of the following except debt to total assets turnover the company has a roe of 30 and stockholders equity of 4000000. B debt to equity ratio. Asset utilization ratios are used to measure managements ability to.

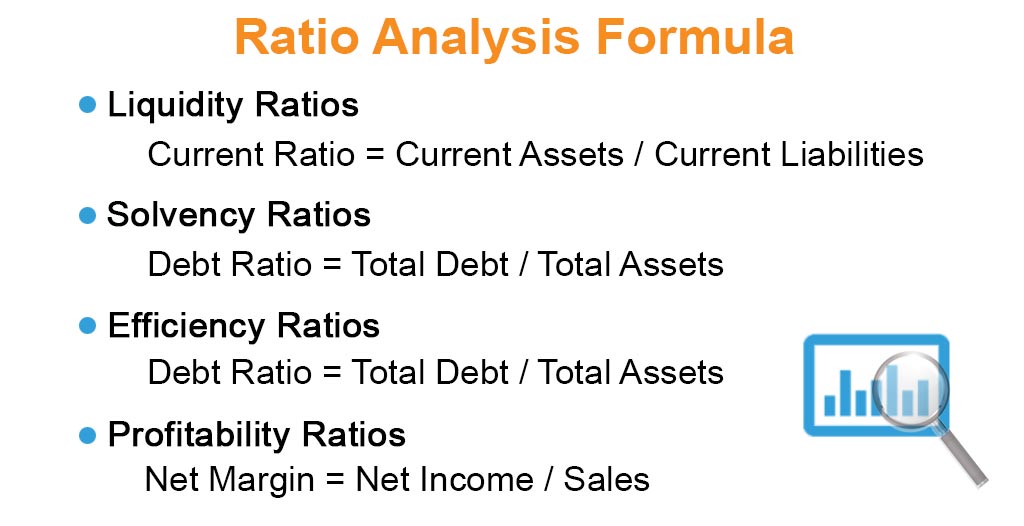

This figure which is simply calculated by dividing a companys sales by its total. Some common liquidity ratios include the quick ratio Quick Ratio The Quick Ratio also known as the Acid-test measures the ability of a business to pay its short-term liabilities with assets readily convertible into cash the cash ratio and the current ratio. C Net Income Sales x Sales Average Total Assets ROI.

C how many times per year the inventory is. The debt ratio indicates how much debt the firm is using to purchase assets. Rate of return on total assets b.

Asset Utilization is important to a company because its success is often tied to its ability to manage and leverage its assets. Inventory QA Question 1 10 points In cost-volume-profit analysis a firm breaks even when its total revenues. A productivity of fixed assets in terms of sales B the relationship of the income statement to cash of the asset groups on the balance sheet.

A demand deposits b NOW accounts. Short-term investments or marketable securities c. A debt to asset ratio.

B Asset utilization ratios. Asset utilization ratios describe how capital is being utilized to buy assets. C Increasing current liabilities.

What is the banks asset utilization ratio. Asset utilization ratios measure all of the following except. A Amount Invested Amount of Return ROI.

Rate of return on net sales All of the following ratios directly relate to the analysis of a given share as an investment except. Types of Assets Common types of assets include current non-current physical intangible operating and non-operating. Assesses how rapidly assets deteriorate.

Core deposits typically include all except which one of the following. E coverage of fixed charges. A 545 b 643 c 967 d 1502.

We know that. Asset utilization ratios include all of the following except. Low asset turnover ratios mean inefficient utilization of assets.

A metric called the asset turnover ratio measures the amount of revenue a company generates per dollar of assets. The relationship of sales on the income statement to various assets on the balance sheet. Earnings per ordinary share c.

A debt to asset ratio. In other words it shows if the company uses debt or equity financing. C times interest earned.

D long-term debt to capital structure. Asset-utilization ratios measure all of the following except. Why is asset utilization important.

Liquidity ratios are used by banks creditors and suppliers to determine if a. The asset turnover ratio formula is equal to net sales divided by the total or average assets. Profitability ratios allow one to measure the ability of the firm to earn an adequate return on sales total assets and invested capital.

All of the following ratios measure the profitability of a company except. Asset utilization ratios measure the returns on various assets such as return on total. Equal total costs equal variable costs are.

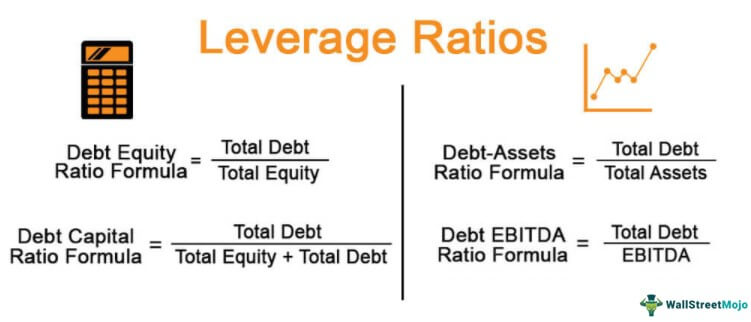

Common financial leverage ratios are the debt to equity ratio and the debt ratio. Return on Investment ROI can be described or computed in each of the following ways except. 70 All of the following ratios reflect leverage ratios EXCEPT.

D Debt utilization. Productivity of fixed assets in terms of sales. 5 In trying to measure a companys effectiveness in earning an adequate return on sales we would use which groups of ratios.

Asset utilization ratios measure all of the following except A productivity of fixed assets in terms of sales B the relationship of the income. A company with a high asset turnover ratio operates more efficiently as compared to competitors with a lower ratio. Asset Utilization Ratios Types receivable turnover.

E All of the above describe ROI. Liquidity Ratios Types current ratio. How many times per year the inventory is.

Low asset turnover ratios mean that the company is not managing its assets wisely. It includes a code editor with features as texti cutting and pasting searching and replacing text automatic indenting brace matching syntax highlighting and provides simple one-click mechanism to compile and uplaod programs to an.

Leverage Ratios Definition Examples How To Interpret

Ratio Analysis Formula Calculator Example With Excel Template

Asset Turnover Ratio Formula Ratio Asset Meant To Be

Efficiency Ratios Overview Uses In Financial Analysis Examples

Comments

Post a Comment